Life Assurance Premium Relief

Policy was taken in April 2011 and sum assured was Rs. Any employee who has a life assurance policy will have the premiums paid for the life assurance policy deducted and tax exempted.

Pin On Cars That Make You Smile

Life Assurance Premium Relief LAPR will no longer be available for premiums due on or after 06 April 2015 What is LAPR.

Life assurance premium relief. Premium limitation on qualifying life policies and restricted relief qualifying policies. Life imitates art. Life assurance premium relief is similar to these topics.

Life Assurance Premium Relief LAPR Question Answers 1. Mr Teo is eligible for Life Insurance Relief of 3400 for Year of Assessment 2021. Premiums are not usually deductible against income tax or corporation tax however qualifying policies issued prior to 14 March 1984 do still attract LAPR Life Assurance Premium Relief at 15 with the net premium being collected from the policyholder.

There are no BIK implications for the individual. Life assurance premium relief LAPR was a United Kingdom taxation rule. Life Assurance Premium Relief LAPR is on its way out.

It is a tax relief received by policyholders who are UK resident and whose Life Assurance policy was qualifying and set up on or before 13th March 1984. Life assurance premium relief LAPR was a United Kingdom taxation rule. Bloomsbury Professional Publication Date.

Our Sao Paulo office was asked by the Brazilian Insurance association to assist in gathering some basic infor-mation regarding the existing tax relief benefits that are present in other markets. 30000 on life insurance policy taken in the name of his wife. If you still have a policy which was taken out with Britannic Assurance Swiss Life or Pearl Assurance where a collector used to call to collect premium payments known as an industrial branch policy there may be an impact upon the terms.

It is due in respect of premiums payable under any such life assurance policy issued in respect of an insurance made before 20 March 1968. United Kingdom corporation tax Institute of Indirect Taxation Tax return United Kingdom and more. Before the amendment to the Personal Income Tax Act in 2011 there were relief in form of personal children.

Relief given by deduction. This article is relevant to takers of the CII FA1 and R05 exams. Premium paid on his life insurance policy of Rs.

This memorable date was when Life Assurance Premium Relief LAPR was abolished for new life policies. Premiums paid into Personal pension term insurance qualify for tax relief at the life insureds marginal rate of income tax subject to certain limits. Reliefs for Personal Income Tax.

Depending on the contract other events such as terminal illness or critical illness can also trigger. General description of the measure Income tax relief of 125 per cent is available on regular premiums paid into qualifying life insurance policies issued on or before 13 March 1984. Limits of relief on premiums other than those securing capital sums on death.

1000 on his another life insurance policy. It is a tax break that may apply to life assurance policies that provide for a capital sum to be paid on death where the policy commenced prior to 14 March 1984. Insurance Policyholder Taxation Manual.

The government has announced plans to abolish life assurance premium relief LAPR in the budget. Life assurance premium relief was part of the original income tax code introduced byWilliam Pitt the Younger in 1799 to help fund the Napoleonic Wars. Life Assurance Premium Relief LAPR payments from HM Revenue Customs HMRC in connection with these policies.

Premiums paid into Executive Pension Term Assurance are eligible for tax relief at the appropriate corporate rate subject to certain limits. Lower amount of life insurance value and total annual premium. Some regular premium whole of life policies are also non-qualifying because they are so.

Life Assurance Premium Relief. Yes premiums are paid for by the business and get tax relief since they are treated as a business expense by HMRC. It is a tax break that may apply to life assurance policies that provide for a capital sum to be paid on death where the policy commenced prior to 14 March 1984.

IPTM2120 - Life assurance premium relief. How will this change affect my policy. To prepare this report I surveyed the market situa-.

Can I get tax relief on premiums. Looking through the new FA1 manual it jumped out at us here at Brand Financial Training that there are over three pages dedicated to Life. Of questions we have recently received relating to the 3600 annual premium limit imposed on certain qualifying life assurance policies.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. Premium was due in March 2022 but was actually paid in April 2022. Read on to learn what impact this change will make on policyholders and the industry.

In the case of policies taken out before that date tax relief continued to be due for premiums paid in respect of plans that were qualifying life. Life assurance premium relief. It is one of the 43 tax reliefs targeted for removal by Chancellor George Osbourne in a bid to simplify the tax system.

Check if your insurer has premium relief for you If money is tight and you cannot pay your short-term insurance premiums downscale rather than lose your cover. Difference between 5000 and total compulsory employee CPF contribution. LAPR is an income tax relief allowed to policyholders on premiums in respect of qualifying policies issued before 14 March 1984.

Relevant life cover isnt treated as a benefit in kind either so company directors can win again since a personal life insurance policy would have to be paid for using taxed income. The lower amount is. These Regulations supplement Schedule 4 to the Finance Act 1976 which as amended by Schedule 3 to the Finance Act 1978 provides a new system for income tax relief on life assurance premiums.

The scheme is administered centrally by a unit within Savings Schemes Office St Johns House Merton Road.

Best Life Insurance Companies For 2021 65 Reviewed Life Insurance Companies Best Life Insurance Companies Life Insurance Quotes

4 Types Of Insurance You Need To Protect Your Business Life Insurance Policy Term Life Life Insurance Companies

13 Insurance Quotes Life Insurance Quotes Near Me

Pin On Insurance Awareness In India

What Is Tds Tax Deducted At Source How To Pay Tds Online Tax Deducted At Source Life Insurance Premium Life Insurance Companies

Life Insurance Helps You Plan Ahead With Life Insurance Premium Calculator And Term Insur Life Insurance Premium Life Insurance Calculator Debt Relief Programs

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

Why Do So Many Millennials Overestimate The Cost Of Life Insurance Life Insurance Life Happens Insurance

Essentials Of A Universal Life Insurance Plan Universal Life Insurance Life Insurance Quotes Life Insurance Calculator

![]()

Life Insurance Icon Stock Illustrations 20 847 Life Insurance Icon Stock Illustrations Vectors Clipart Dreamstime

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

The Big Online Store Life And Health Insurance Life Insurance Quotes Life Insurance Companies

Top 10 Financial Tips Financial Tips Finance Infographic Smart Finances

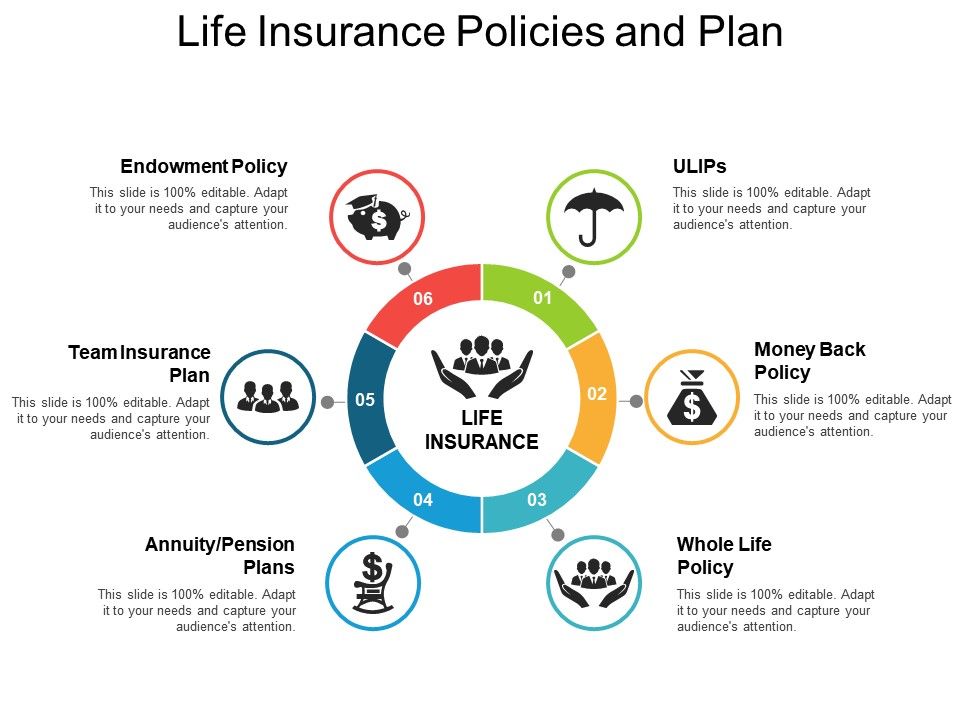

Life Insurance Policies And Plan Template Presentation Sample Of Ppt Presentation Presentation Background Images

Life Insurance Policies Stock Illustration Illustration Of Insurance 135489659

If You Are Already Growing Old You Should Consider Planning For Your Burial So As T Life Insurance For Seniors Life Insurance Quotes Life Insurance Companies

Posting Komentar untuk "Life Assurance Premium Relief"