Pension Term Assurance Plan

While this kind of policy is no longer available to new customers those with such policies active are still entitled to continue them and to. There are several types of Term Assurance.

Sbi Life Saral Pension Plan One Of The Best Retirement Policy In India

Until the end of 2006 pension term assurance was available as a form of life insurance that could be bought as part of a pension plan complete with the associated tax breaks.

Pension term assurance plan. This type of policy is useful for providing security for your dependents up to a certain age. You may need to move into a new pension plan to do this. A term assurance policy will be set up for a specific number of years.

Pension Term Assurance is life cover that pays out a lump sum if you die during the term of the plan. A personal pension plan that is contracted-out is known as an appropriate pension scheme for these purposes. You will also benefit from tax relief on the premiums paid.

Often people think about when their dependants may start earning their own income or the number of years left on a mortgage. Premiums stay the same for the whole term. For Executive Pension Term you are covered to the normal retirement age of your employers pension scheme however there are restrictions on the level of cover provided.

Pension Term Assurance from Royal London is a special type of Term Assurance designed to provide Life Cover to those in nonpensionable employment. You can put a financial safety net in place so that if you are not around to provide for your family anymore you have still taken care of them financially. This includes for example a selfemployed person or someone who is not a member of an employersponsored Pension plan.

Decreasing Term Assurance Life assurance for a fixed period of time or specified age but where the sum assured decreases each year. Pension Term Assurance Executive Pension this plan offers the same financial protection and is geared toward self employed or those not in pension able employment. 85 years minus entry age.

Aegon Life Guaranteed Income Advantage Plan. Bright Grey is a division of Royal London. Made at the discretion of the Scheme Administrator of the Royal London Personal Pension Scheme.

An authorised investment firm life assurance company or credit institution which produces markets or sells PRSA products. Rolls-Royce reveals its first fully electric car arriving in 2023. There are two different types of term life.

Britains Garage of the Year 2021 nominees incredible construction. If the life assured survives until the end of the term the policy will expire and there will be no monies payable. The sum assured under the policy is only paid out if death occurs within a specified term.

Plan details for the Pension Term Assurance plan April 2006 This booklet sets out the terms and conditions of your plan how it works what you can expect us to do and what we can expect you to do. Pension Term Assurance The truth behind the hype Rod McKie Stephen Griffiths So whats the truth behind the hype. The cost is guaranteed not to increase before that date unless you.

This includes self-employed people or people who are not members of an employer-sponsored pension plan. Eligible policyholders pay their full premium to Royal London and then claim tax relief at their marginal rate from Revenue. Executive Pension Term Assurance provides a lump sum amount for the family of executive employees in the event of their death while in employment before they reach retirement.

However if you want to nominate someone to receive this payment you can do so using this form. 5 years- 30 years. Aditya Birla Sunlife Empower Pension Plan.

Under this plan you pay a set amount on a regular basis usually by direct debit until you retire. A shortened name for Pay Related Social Insurance whereby workers earning. The Royal London Group consists of The Royal London Mutual Insurance Society Limited and its.

It is a financial safety net so that if they are not around to provide for their family anymore their family will be taken care of financially. If you are employed and paying into a pensions-term assurance contract you will avail of 6pc PRSI relief on the monthly cost of the cover also. Pension Term Assurance is designed to provide Life Cover to those in non-pensionable employment.

The term is also fixed. Pension term assurance explained. Term life insurance covers you for a specified amount of time or the term of the policy.

Payment is made if you die during the term. Personal Pension Term Assurance provides a lump sum amount for your family in the event of your death before you reach retirement. You pay a regular amount of money into your Pension Term Policy.

Pension term assurance. Once your Plan has started if any of your Plan premiums become ineligible for tax relief you may be able to convert your Plan to an. This is known as the term.

The lump sum payment under your Pension Term Assurance plan payable on your death will be. Replaced flexible drawdown and capped drawdown from April 2015 though existing users of capped drawdown can continue in that plan. Term Assurance is life insurance in its cheapest form.

A major attraction of a Pension Term Assurance policy is that currently if. Therefore if you are earning over 45400 in. Pension Life Insurance or as it is sometimes referred to as Pension Term Assurance is a single life insurance plan that can be taken out before you retire.

The advantage of this type of life cover is that it costs less because you may be eligible to claim tax relief on your contributions up to certain limits. Your contribution can provide the level of life cover you need until the date you have chosen for retirement. Pension Term Assurance is life cover that pays out a lump sum if you die during the term of the plan.

Click to open Decreasing term assurance. If you die during this specified term the policy will pay out so that your dependents are cared for financially. Depends on the coverage age term and premium.

Another term for pension scheme. Pension Term Protection is life insurance designed to protect your family financially if you die before you retire. Click to open Level term assurance.

In the event of death it pays out a guaranteed lump sum which can be used to pay bills or loans or to potentially provide a. You can choose the length of time you want whether it be 1 year or 50 years. A Pension Term Assurance plan.

![]()

Pension Term Assurance Royal London

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

Pension Term Assurance Royal London

Find Your Policy Type What Type Do I Have Phoenix Life

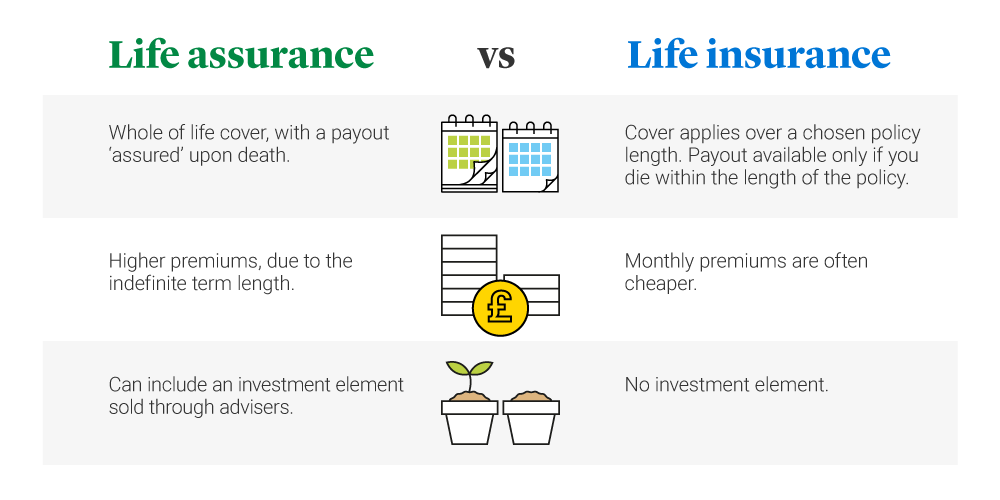

Life Assurance Vs Life Insurance Legal General

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

What Is An Annuity Meaning Definition Benefits Types

Term Insurance Plan With Return Of Premium Exide Life Insurance Inapp00087 Exidelife

![]()

Pension Term Assurance Royal London

Term Insurance Best Term Plans Policy Online In India 2021

Difference Between Endowment And Money Back Plan Policyx Com

Lic Jeevan Umang 945 Reviews Features And Benefits Policyx Com

![]()

Pension Term Assurance Royal London

What Is Life Insurance Exact Definition Meaning Of Life Insurance

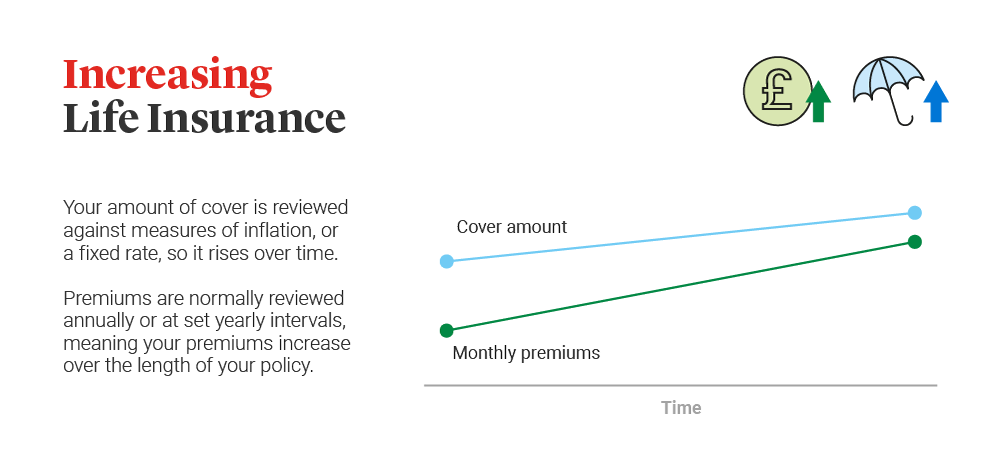

Types Of Life Insurance Legal General

Pension Term Assurance Royal London

Sbi Life Retire Smart Plan One Of The Best Retirement Policy In India

Posting Komentar untuk "Pension Term Assurance Plan"