Life Assurance Exit Tax Revenue

This meant that the company would be deemed to have disposed of and reacquired its assets at market value on the date of tax migration with the. Citizenship or long-term residency by non-citizens may trigger US.

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Together these constitute the taxation of life assurance companies under the I E basis that is Income less Expenses.

Life assurance exit tax revenue. The tax is deducted from the fund by the fund manager and passed on to Revenue. Accounts Regulation 1996 extract from Tax Briefing - Issue 24 December. The Finance Bill was signed into law by President Higgins on 21 December 2015 and it confirmed the following that may be of importance to your clients.

Submitted article to The Actuary magazine. In this first of our two-part series we explain some of the. The exititstax charge applies where.

Life Assurance Policies - Exit Tax ingested February 16 2018 Part 26-05-03. In a pre-budget submission Irish Life has also again asked the Government to align the exit tax on life assurance policies with deposit interest retention tax Dirt which is now 37 per cent. Exit tax is charged on the investment profit or gain element of a life policy on certain chargeable events.

The Life Assurance Company pay the tax directly to Revenue. Old basis business is generally apportioned between shareholders and policyholders and taxable as follows. And b the completion of Declaration Forms have been updated on the Revenue website.

If when you eventually exit the fund the gain you make is less than that already taxed you are entitled to claim. Life Assurance Exit Tax LAET is payable on the gain made on a life assurance policy. Exit tax is payable on profits made on plans held with life assurance companies.

Under this regime all life assurance companies are charged to tax under Case I of Schedule D on shareholders profits. Repayment of exit tax. Legislative Updates Exit Tax on Life Assurance Policies.

If a plan has a larger return than the amount invested the difference is subject to exit tax. Appendix 1 New Life Assurance Regime - Tax computations Tax Briefing - Issue 43 April 2001 Appendix 2 Tax Implications for Life Assurance Companies EC. Life assurance companies trading from the IFSC exclusively with non-resident customers are taxed in accordance with the rules applicable to Case 1 of Schedule D - section 710 2 TCA 1997.

So if eligible this valuable option could save you up to 40 on the cost of your Life Cover. LIFE ASSURANCE EXIT TAX General Guidelinesfor Life Assurance Company administrators in relation to a the calculation of tax due on income and gains from investments in domestic life assurance policies. In respect of life assurance business contracted for on or after 1 January 2001 this tax regime of life assurance companies and their policyholders has been replaced by a new regime see Chapters 4 and 5 of this Part.

As regards life assurance policyholders when a chargeable event occurs in respect of a policyholder the life assurance company must deduct exit tax from the investment gain on. Irish Revenue issues specific guidance on revised Exit Tax Rules. This includes for example a self-employed person or someone who is not a member of an employer-sponsored pension plan.

Life Office Taxation - Consultation from the Inland Revenue. Savers looking for better returns have been dealt a blow after the Department of Finance concluded there is no justification for cutting the tax on life insurance funds to bring it into line with. The exit tax is the standard rate of income tax.

The expatriation tax consists of two components. Depending on the contract other events such as terminal illness or critical illness can also trigger. Tax and Duty Manual Part 20-02-01 5 1 Charge to exit tax section 6272 6273 11 Events which give rise to a charge to exit tax Section 627 imposes an exit tax charge with effect from 10 October 2018.

If a policy has a return that is greater than the amount invested that difference is a gain and LAET is deducted on this amount. Life Assurance Policies - Exit Tax ingested November 24 2017 Related Content. The company will write to you and notify you of the tax paid and quote the investments current value.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. And b the completion of Declaration Forms have been updated on the Revenue website. Budget 2011 - Consultation on Changes to Life Assurance Taxation May 2011 Tax after Solvency II presentation Life Conference 2011 Drafted letter for Chair of LPEC to send to HMRC on Taxation of capital support to long term funds.

The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. In effect this means that the shareholders profits are taxed at the 10 per cent corporation tax rate and no tax is levied on policyholders funds. Life assurance business written on or before 31 December 2000 is referred to as old basis business.

Tax deductible life insurance is a type of Term Life Assurance designed to provide Life Cover to people in non-pensionable employment. The life assurance company is obliged to deduct any tax due directly from the gain and pay it to Revenue. I took out my investment policy before 01012001 am I liable for Exit Tax.

An exit tax is generally deducted by the life company when the chargeable event occurs. Prior to 10 October 2018 Irish tax law provided for an exit charge where a relevant company ceased to be tax resident in Ireland. LIFE ASSURANCE EXIT TAX General Guidelinesfor Life Assurance Company administrators in relation to a the calculation of tax due on income and gains from investments in domestic life assurance policies.

It only applies to policies taken out after this date.

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

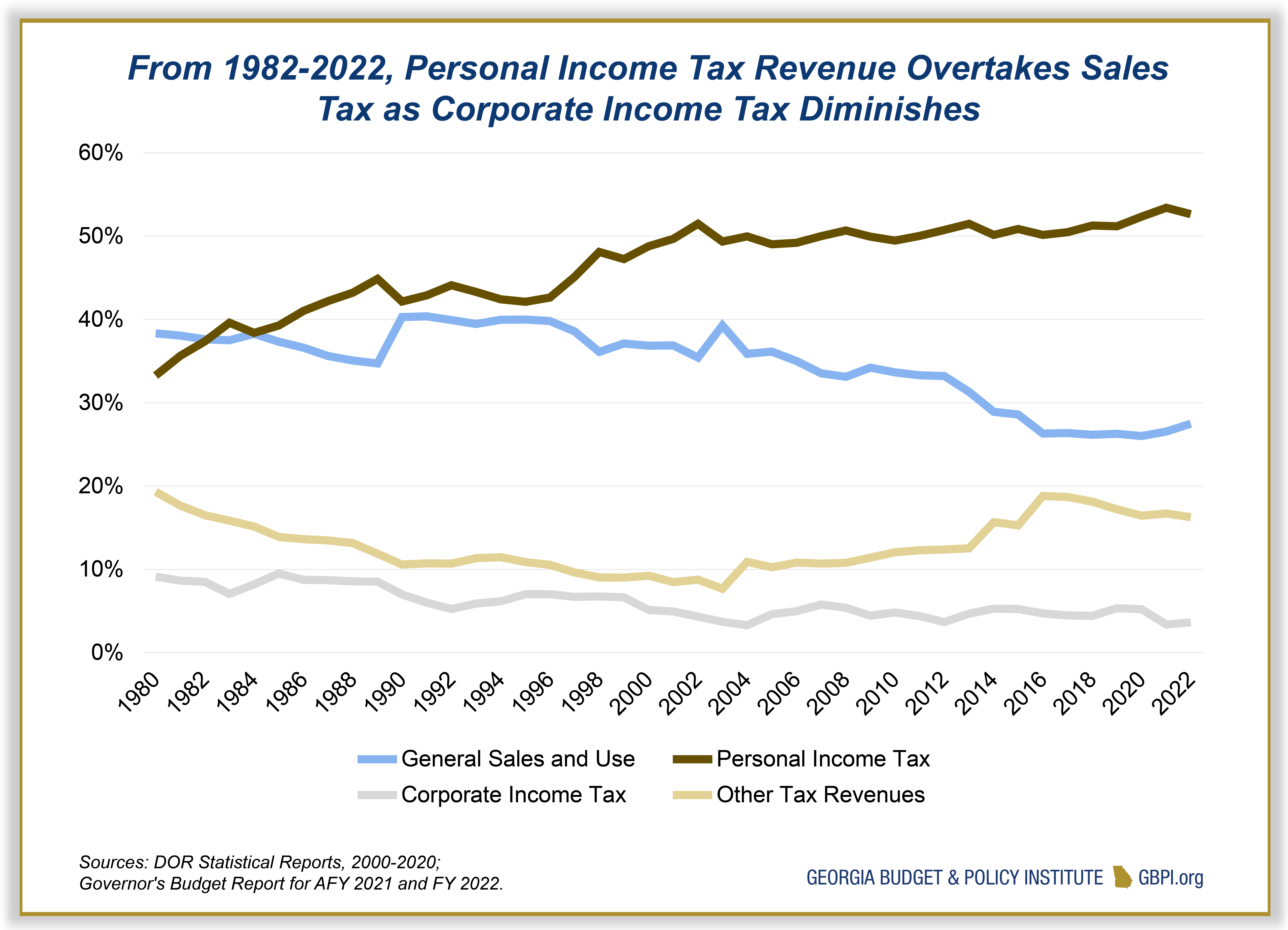

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

Image Result For Non Profit Organizational Chart Non Profit Nonprofit Organization Organization

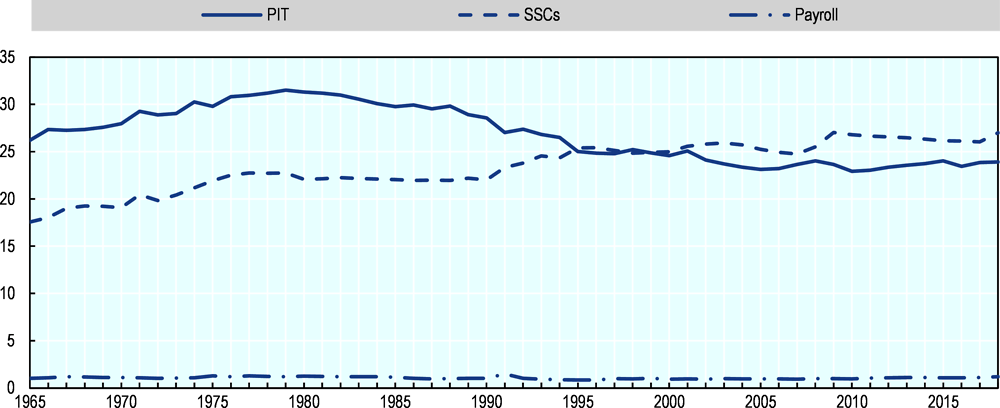

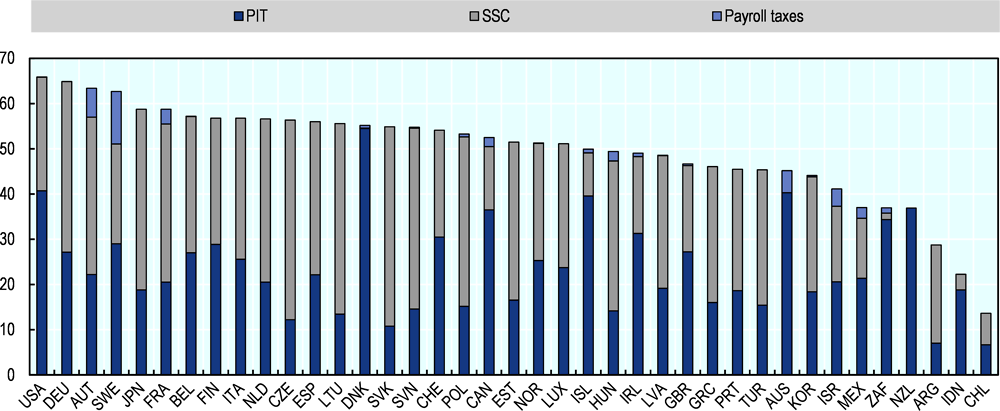

Taxation In Aging Societies Increasing The Effectiveness And Fairness Of Pension Systems G20 Insights

1 Key Policy Insights Oecd Economic Surveys Thailand 2020 Economic Assessment Oecd Ilibrary

Kingdom Of The Netherlands Aruba 2021 Article Iv Consultation Discussions Press Release Staff Report And Staff Supplement In Imf Staff Country Reports Volume 2021 Issue 081 2021

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

Reserve Bank Of India Transfer Tops Govt S Non Tax Revenue Source Business Standard News

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Get The Perfect Solution For Your Irs Tax Problems Consult Here Http Bit Ly 29k5dh3 Tax Software Mortgage Interest Financial Aid For College

9 Myths About The 183 Days Rule Ttt Group Ttt Group

Pdf Impact Of Infrastructure On Tax Revenue Case Study Of High Speed Train In Japan

Rural Postal Life Insurance Rpli Rate Of Bonus For F Y 2021 22 Applicable From 01 04 2021 In 2021 Office Insurance Life Insurance Policy Life Insurance

Pdf Impact Of Infrastructure On Tax Revenue Case Study Of High Speed Train In Japan

A Big Tax Shift Has Hit South Africa And It Could Cause Problems

Fiscal Sustainability And Hydrocarbon Endowment Per Capita In The Gcc Springerlink

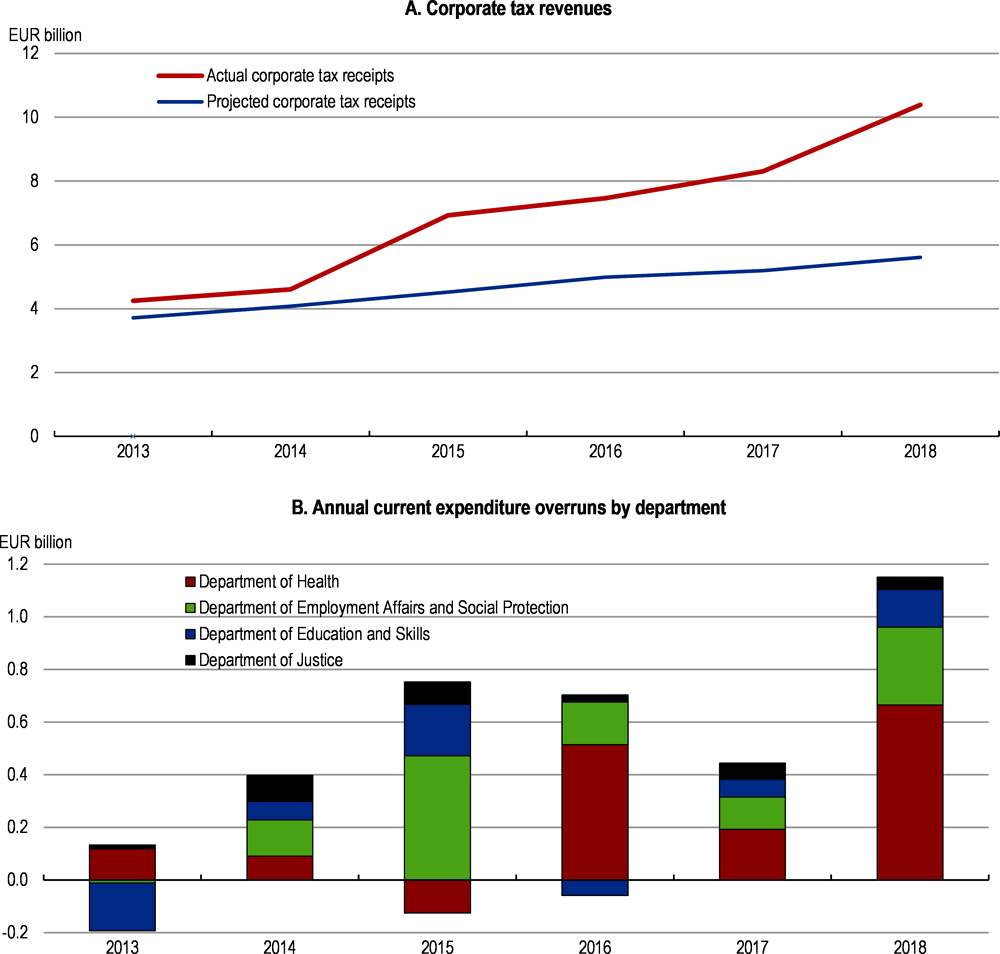

Key Policy Insights Oecd Economic Surveys Ireland 2020 Oecd Ilibrary

Posting Komentar untuk "Life Assurance Exit Tax Revenue"