Pension Term Assurance Uk

You can choose the length of time you want whether it be 1 year or 50 years. How did protection providers respond to A day.

Life Insurance Converage Life And Health Insurance Life Insurance Marketing Ideas Life Insurance Sales

What has the impact been on existing business.

Pension term assurance uk. Personal term assurance is a life insurance. We specialise in dealing with the retirement planning needs of international clients. Did innovation or me too products lead the way.

You are not entitled to tax relief when you make personal term assurance contributions. A payment will only be made if the life assured dies during that period. Providers start offering policies with this in mind called pension term assurance plans.

The UK state pension is made up of two parts - the basic state pension and the Second State Pension or S2P. HS347 PDF 286KB 3 pages This file may not be suitable for users of assistive technology. Are You A UK Expat.

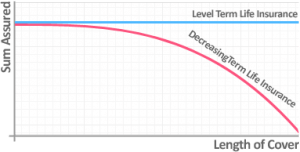

Pension Term Assurance was made available from April 2006 and is basically Term Life Assurance with tax relief on premiums. Comparative pensions UK pensions especially state pensions rank amongst the worst in the EU and are unlikely to improve even when personal accounts come on stream. Pension Term Assurance PTA can be either a Level or a Decreasing term life assurance contract which will allow tax relief to be claimed.

Pension term assurance policy 37 a personal pension policy which is a pure protection contract and in connection with which tax relief is available under Chapter 4 of Part 4 of the Finance Act 2004. Ad Vast experience in helping expatriates worldwide plan and achieve their retirement goals. Term life insurance covers you for a specified amount of time or the term of the policy.

Are You A UK Expat. A major attraction of a Pension Term Assurance policy is that currently if. How did distributors respond to PTA.

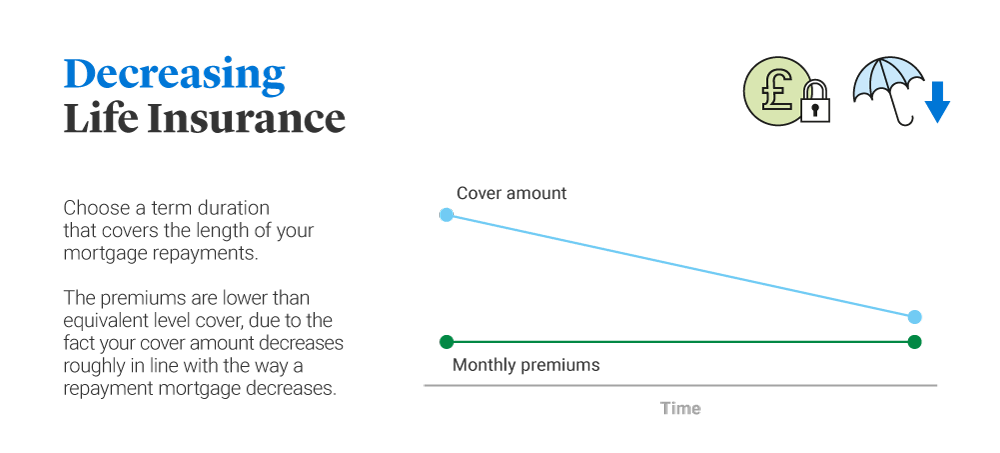

Premiums stay the same for the whole term. What impact did PTA have on pricing. The term is also fixed.

Rolls-Royce reveals its first fully electric car arriving in 2023. Click to open Level term assurance. There are several types of Term Assurance.

Payment is made if you die during the term. Ad Are You A UK Expat. PENSION TERM ASSURANCE CHANGES.

If the life assured survives until the end of the term the policy will expire and there will be no monies payable. You cant get tax relief if you use your pension contributions to pay premiums for a personal term assurance policy unless its a protected policy. This type of policy is useful for providing security for your dependents up to a certain age.

Often people think about when their dependants may start earning their own income or the number of years left on a mortgage. We specialise in dealing with the retirement planning needs of international clients. Click to open Decreasing term assurance.

Decreasing Term Assurance Life assurance for a fixed period of time or specified age but where the sum assured decreases each year. UK Regulated Pension Transfers. There are two different types of term life.

The sum assured under the policy is only paid out if death occurs within a specified term. This includes for example a selfemployed person or someone who is not a member of an employersponsored Pension plan. Contributions paid by or on behalf of a member to a registered pension scheme to purchase personal term assurance will not be relievable pension contributions unless they relate to a protected.

Before 2006 a sort of loophole existed in UK pension legislation that allowed customers to purchase life insurance plans as part of their pensions thereby enjoying the same tax relief on their insurance premiums as they did on contributions to their pensions. Do You Need Help With Your UK Pension. Ad Vast experience in helping expatriates worldwide plan and achieve their retirement goals.

A term assurance policy will be set up for a specific number of years. Do You Need Help With Your UK Pension. This includes self-employed people or people who are not members of an employer-sponsored pension plan.

Ad Are You A UK Expat. Pension Term Assurance from Royal London is a special type of Term Assurance designed to provide Life Cover to those in nonpensionable employment. Tax relief will no longer be available for all contributions made on or after 1 August 2007 under occupational pension schemes in respect of PTA policies unless the insurer received the policy application before 29 March 2007 and.

Personal term assurance contributions to a registered pension scheme The notes on page TRG 17 of the tax return guide explain the limits to the tax relief to which you are entitled for pension contributions. Britains Garage of the Year 2021 nominees incredible construction. Get Help With Your UK Pension Regulated Pension Transfer Advice.

HS347 Personal term assurance contributions to a registered pension scheme 2014 Ref. Get Help With Your UK Pension Regulated Pension Transfer Advice. Pension Term Assurance is designed to provide Life Cover to those in non-pensionable employment.

UK Regulated Pension Transfers. Few payments are personal term assurance. Term Assurance is life insurance in its cheapest form.

This is known as the term. Pension term assurance explained. Eligible policyholders pay their full premium to Royal London and then claim tax relief at their marginal rate from Revenue.

Pension Term Assurance The truth behind the hype Rod McKie Stephen Griffiths So whats the truth behind the hype.

Citizens Advice Ireland Redundancy In 2021 Life Insurance Quotes Income Protection Insurance Buy To Let Mortgage

Life Insurance Cheat Sheet Family Title C Graphic Line Calculator C Timashov Sergiy Question M Life Insurance Medical Insurance Insurance Marketing

How Does Decreasing Term Life Insurance Work Guide Drewberry

Pin By Philinvest Insurance Investm On Philinvest Insurance Investment Services Investment Services Insurance Investments Investing

What Is Term Insurance Life Cover Insurance Abi

Consumer Guide What Should You Do If You Have A Life Insurance Policy Or Pension From The Uk Eiopa

Pension Term Assurance Policies Have Implications For Annual Allowance Ftadviser Com

![]()

Pension Term Assurance Royal London

![]()

Pension Term Assurance Royal London

Life Insurance Overview Types How To Buy Life Insurance Companies Life Insurance Companies Life Insurance Agent Life Cover Insurance

Life Insurance Infographic Life Insurance Marketing Ideas Life Insurance Sales Life Insurance Marketing

Life Insurance Policy Avail A Variety Of Life Insurance Policy Plans In India Visit Our Websit Life Insurance Life And Health Insurance Life Insurance Facts

Types Of Life Insurance Legal General

Almost 9 In 10 Agree That Most People Need Life Insurance Life Insurance Financial Peace Insurance

Indemnity Calculation Kuwait Online 2021 In 2021 Indemnity Kuwait Days And Months

![]()

Pension Term Assurance Royal London

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

Life Insurance Companies Offers The Best Life Insurance Policy In India Check Out Various Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Life Insurance Meant To Protect Them Not You Smg Lifeinsurance Protectwhat In 2021 Life Insurance Agent Life Insurance Marketing Ideas Life Insurance Marketing

Posting Komentar untuk "Pension Term Assurance Uk"