Capital Sum Assured

Lets say Mukesh buys a ULIP plan with a sum assured of Rs 10 lakh and a 20-year premium of Rs 50000. 30000 he will be eligible to claim deduction of Rs.

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

Define Capital Sum Insured.

Capital sum assured. It is important to note that the premium amount and the sum assured are directly related. Say Rakesh purchases a ULIP plan with a sum assured of Rs 10 lakh with an annual premium of Rs 50000 for 20 years. Sum assured is Rs.

In most circumstances the minimum sum assured. What is Sum Assured. The higher the premium paid the greater is the sum assured.

Sum insured and sum assured are among the fundamental terms that an individual essentially needs to understand before choosing a life insurance planThe two terms are the basis on which a plan is evaluated. Sum insured is the amount of money that an insurance company is obligated to cover in the event of a covered loss. 4 Premium in respect of policy taken in the name of his children works out to be 5 of.

For a sum assured of Rs. So if you pay an annual premium of INR 10 000 the sum assured would become INR 1 lakh. Wife deduction will be restricted to 10 of capital sum assured.

You can now find Human Life Value calculators online to know your HLV and select the right sum assured. Though a novice might interpret the sum assured and sum insured to mean the same their actual meanings are significantly different. What is actual capital sum assured in relation to a life insurance policy.

20000 hence out of Rs. Sum insured in insurance is defined by the principle of payment that provides a cover or compensation for damage loss or injury. The sum insured correlates directly to the amount of premium you pay but not always to the propertys actual value or.

This is prospective that is it applies only from 2012-13. What Does Sum Insured Mean. 10 lakh the maximum premium that you can pay to deduct under section is Rs.

Sum assured is a pre-defined sum that the insurance company agrees to pay to you or your nominee. Its worth noting that the premium amount and the sum assured are inextricably linked. Here the premium exceeds 10 of capital sum assured and so the maturity proceeds is taxable in the year of receipt ie.

Both terms refer to sum assured as defined. The sum assured depends upon the income of the person and typically a maximum of up to 10 times the annual income is allowed as the sum assured. The insurance company pays this money as per the sum chosen by you at the time of purchasing the policy.

This figure is the guaranteed amount of money that your loved ones will receive in your absence provided all. In any case of any eventuality like death the sum assured is the amount that is paid to the beneficiary. Thus the sum assured and premium of a life insurance policy are interconnected.

The sum assured in such plans is expressed as a multiple of the premium amount. The sum assured is the amount that has been pledged. A qualifying policy must secure a minimum capital sum on the death of a life assured.

In this TATA AIA blog learn more. The greater the sum assured the higher the premium paid. This term is commonly associated with homeowners or property insurance but can also apply to other types of insurance.

A sum assured is a fixed amount that is paid to the nominee of the plan in the unfortunate event of the policyholders demise. This method calculates sum assured based on your current and future expenses present and future earnings and age. Means the sum as specified in the Schedule to this Policy against the name of Insured Insured Person which sum represents the Companys maximum liability for any or all claims under the Accident benefits during the Policy Period against the respective benefits.

Any sum received other than as death benefit under an insurance policy which has been issued on or after April 1 2003 and if the premium paid in any of the years during the term of the policy is more than 20 of the Actual Capital Sum Assured. Here the premium exceeds 10 of capital sum assured and so the maturity proceeds is taxable in the year of receipt ie. The premium needs to be less than 10 of sum assured for an 80C deduction.

The sum assured is the amount of money an insurance policy guarantees to pay up before any bonuses are added. The capital sum assured will not include rider benefit sum assured like critical illness rider accident benefit term rider premium waiver benefit etc. Concept of Sum Insured Vs Sum Assured.

Sum assured is the value of the insurance cover provided at the time of buying the insurance policy. Restriction on amount of deduction with respect to capital sum assured Eligible Premium under Sub-section 3 and 3A of 80C of Income Tax Act1961 For regular Life Insurance Policies other than contract for deferred annuity Issued from 01042012 premium paid not in excess of 10 of Capital Sum Assured as amended by Finance Act 2012. Guidelines to determine the.

It helps you calculate your capitalized value based on current inflation. Sum assured means the guaranteed sum that will be paid if you die. But what I wish to contest today is the term sum assured used by the Irda circular and the term capital sum assured used by Section 70 of DTC.

As per the section 80C of the Act actual capital sum assured in relation to a life insurance policy shall mean the minimum amount assured under the policy on happening of the insured event at any time during the term of the policyIt excludes-a the value of any premium agreed to be returned orbany. During the current COVID-19 pandemic more people are now thinking about financial planning one pillar of which is life insurance. In other words sum assured is the guaranteed amount the policyholder will receive.

Life insurance is one of the most trustworthy ways to safeguard your family against the uncertainties of life. 200000 and 10 of the same will work out to be Rs. The capital sum assured will not include any bonus return of premium etc.

Assume that Rs 25000 of the premium is spent. It is further proposed to insert the definition of actual capital sum assured so as to provide that the actual capital sum assured in relation to a life insurance policy shall be the minimum amount assured under the policy on happening of the insured event at any time during the term of the policy not taking into account i the value of any premiums agreed to be returned or ii. IPTM8030 - Minimum capital sum assured on death.

Usually the multiple is expressed as 10 times the premium paid.

Endowment Policy Compare Best Endowment Plans Online

Sbi Life Saral Jeevan Bima Life Insurance Protection Plans

Nations Assurance Capital Nations Trust Bank

Faqs On Taxation Of Ulips Taxmann Blog

Sbi Life Smart Shield One Of The Best Term Insurance Plan In India

Guaranteed Monthly Income Savings Plan Sbi Life Smart Money Planner

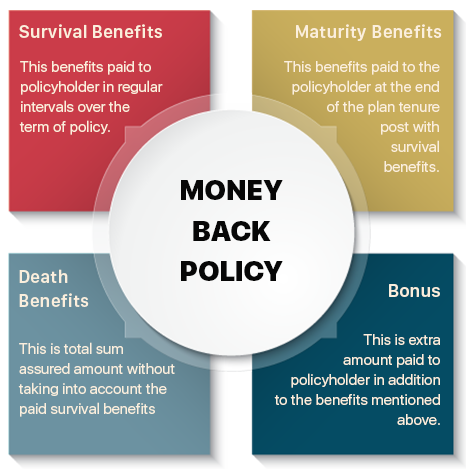

Money Back Policy Compare Money Back Plans Features Reviews

Money Back Insurance Plan Smart Income Protect Sbi Life

Sbi Life Smart Wealth Assure Best Single Premium Ulip Policy

Sum Assured Meaning In A Guaranteed Savings Plan

Know The Difference Between Sum Assured And Fund Value In Ulip Bw Businessworld

What Is Sum Assured Max Life Insurance

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

What Is Sum Assured Max Life Insurance

Section 80c Deduction For Financial Year 2020 21 Ay 2021 22

Qualifying Amount Q A For Deduction U S 80c

How To Calculate Lic Month Wise Return Quora

What Is Sum Assured Max Life Insurance

Posting Komentar untuk "Capital Sum Assured"