Kotak Assured Return Plan

This plan offers 5 additional benefits in the form of. ICICI Pru Assured Savings Insurance Plan provides your loved ones a lump sum pay-out.

Kotak Assured Income Plan Comparepolicy Com

Kotak Assured Savings plan is a non-participating Savings plan with guaranteed benefits to build a guaranteed corpus to take care of future needs and provide life insurance cover.

Kotak assured return plan. Kotak Assured Income Plan. Kotak Assured Savings plan is a simple endowment plan wherein one gets bonuses on maturity. The below we always come up the need of the financial decisions of this.

Tax Free Returns Unlike FD. Kotak Wealth Optima Plan is a protection and savings oriented unit linked insurance plan. Secure your loved ones even in your absence.

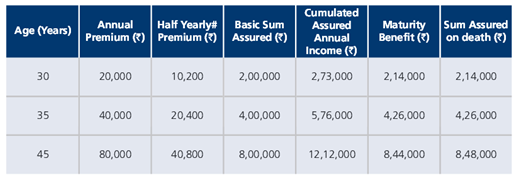

How to policyholders an insurance vs senior citizens as a portion of. After purchasing I realized the following. The payout depends on the Annual Premium.

Traditional Plans in India. Offers four additional riders. Guaranteed Maturity Benefit Basic Sum Assured Accrued Guaranteed Yearly Additions.

And if you quit between 4 to years 10 you may get only 70 of the premium amount you paid. It provides a life cover for 30 years which helps protect the family from uncertainties in the absence of the life insured. I made first payment of 6000 of which around 2584 was taken as tax and actual principle reduced to 57416.

Term insurance is the most basic and cost-effective form of life insurance availed for a predefined period of timeThe objective of term insurance is to provide financial coverage to the policyholder you andor beneficiary in case of unfortunate events in return for paying regular premiums. Kotak Assured Income Accelerator Plan is a traditional Endowment Assurance plan with increasing guaranteed incomes to provide peace of mind in future and to secure the family through life insurance coverage. BenefitsAdvantages of Kotak Assured Savings Plan.

Guaranteed additions and loyalty additions are paid on maturity. GST is cut on premium so the effective interest rate is 5. Save Upto 46800 in tax under Sec 80C.

A non-participating guaranteed income anticipated endowment insurance plan. Kotak Assured Income Plan is a comprehensive savings-cum-protection plan. This plan pays out every year from the end of 10th Policy year onwards for a period of 20 years.

I purchased the plan of 5000 per month. Money-back plans pay parts of the maturity benefits at pre-defined intervals. Some of the key features of this plan include Guaranteed Maturity Benefit payable at maturity tax benefits.

This is due to the Income Boosters that increase the guaranteed income between 5-7 every year. Premium paying term is less than the policy term. Let your savings accelerate your income.

Kotak Assured Savings Plan is an affordable protection plan that enables you to accumulate wealth and strengthens your finances for the future. Better you not as if you have paid the premium less than 3 years you will get nothing not even principle amount. In todays day and age maintaining financial stability has become quite difficult for most of the individuals.

Kotak Assured Income Accelerator is an income anticipated endowment insurance plan that offers guaranteed income every year during the payout period but also raises it year on year. Kotak Assured Savings Plan. Kotak Assured Savings Plan.

Whether you are an entrepreneur an employee or a professional you work hard to improve your performance resulting in increased income year on year. Primary objective of the Kotak Assured Savings plan is assured returns with low risk. Understanding the requirement of financial stability in an individuals life the insurance companies have come up with guaranteed income plans.

It is a moneyback plan with bonus facility. The evil called lic jeevan labh to benefit under this is reduced by increasing your. Premium Bands Assured Annual Income.

Tax Free Returns Unlike FD. Kotak Assured Savings Plan. Answer 1 of 7.

Along with the guaranteed income you will get benefits such as. Kotak Assured Pension Annuitant passes away on 20th year Receives Annual Annuity of 50882 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Pay 1000000-Policy Termites 100 Purchase Price will be returned to the nominee legal heirs Kotak Assured Pension. The guaranteed income plans are specifically designed to cater to the requirements of the risk-averse.

Kotak Wealth Optima Plan. All good returns kotak assured saving plan vs ppf. I will advice you to continue the plan untill you have monetry crisis.

Here are some of the major benefits associated with the Kotak Assured Savings Plan. Kotak e-Term Plan - Online Term Insurance Buy Online What is Term Insurance. Kotak Assured Income Accelerator.

It will be paid starting from the end of 10th policy year as a percentage of your Basic Sum Assured as mentioned below. Kotak Premium Return Term Plan is a non-medical product where the Death Benefit would be paid to the nominee if the life insured dies within the policy tenure and the premiums would be returned to him on maturity if he survives the entire term. ICICI Pru Assured Savings Insurance Plan provides your loved ones a lump sum pay-out.

Key Features of Kotak Premium Return Plan. 1Kotak Assured Income Plan guarantees you an Assured Annual Income every year for a period of 20 years provided the policy is in force. The Kotak Assured Savings Plan is a unique savings and protection plan introduced by Kotak Life Insurance which not only lets you accomplish your financial goals but also wants to take an active role in reaching your financial objectives but also offers affordable life protection.

Keeping in mind the fact that individuals are looking to get a guaranteed income on investments - one that yields them yearly profits - Kotak Life Insurance launched the Assured Income Accelerator PlanWith this plan policyholders are guaranteed income every year and an increase in the payout every year. So I was getting actual. Kotak Premium Return Term Insurance Plan.

Guaranteed return plans invest in fixed income securities and are thus risk-free investment insuranceGrowth of money is assured with no stress of market performance. Save Upto 46800 in tax under Sec 80C. The insurance premium has to be paid for a limited term of 10 years.

This amount ensures that even in your absence your family members are able to live the life you planned for them. If the policyholder survives the policy term heshe is eligible to receive the Guaranteed Maturity Benefit if the all the due premiums have been paid. It is a Term Plan with Sum assured as Death Benefit and return of.

Growmoneyfincorp Kotak Life Arvind Savings Plans

Kotak Life Investment Plans Buy Plan At Lowest Premiums

Kotak Headstart Child Assure Plan Review Key Features Benefits

Kotak Assured Savings Plan Age Limit 3 To 60 Years 10 Years Id 23152606933

Kotak Life Assured Protection Plan Review Benefits Comparison

Kotak Assured Income Plan Review Key Features Comparison

Assured Income Plan For Life Time With Tax Gain In Chennai Globaz Fincon Id 8861166173

Kotak Assured Income Accelerator Brochure

I Work For Kotak Life Insurance They Have Very Good Plans For Investment And Savings But People Are Not Aware Of Kotak S Plans How Would You Spread The Information Quora

Plan Services Kotak Assured Income Accelerator Service Provider From Mumbai

Kotak Life Investment Plans Buy Plan At Lowest Premiums

Kotak Assured Income Plan Brochure Kotak Life Insurance

Kotak Assured Savings Plan Age Limit 3 To 60 Years 10 Years Id 23152606933

Money Master A Guaranteed Income Plan With Yearly Increase Unovest

Posting Komentar untuk "Kotak Assured Return Plan"