Decreasing Term Assurance Explained

Decreasing term assurance How it works and when it is useful. This type of life assurance is commonly used to protect Capital Repayment mortgage debt.

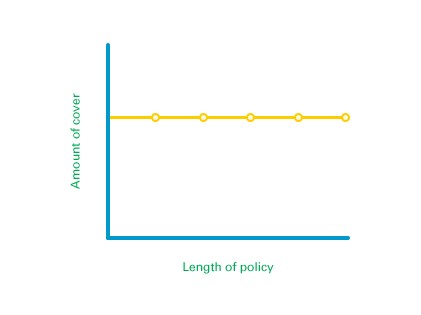

Level Term Life Insurance Legal General

A decreasing term assurance policy sees the amount to be paid out sum assured decreasing over the term of the policy.

Decreasing term assurance explained. With a decreasing term policy you will choose a length of time for the policy to run so it will have a start and an. Because the sum insured decreases over time monthly premiums tend to be much lower for decreasing-term life. As the amount you need to pay on your mortgage also decreases this is the policy that is usually used to provide this kind of cover.

Decreasing term is a type of term life insurance which provides affordable and flexible coverage for a set period of time. Term means it has a fixed number of years to run and eventually expires. Term Assurance is life insurance in its cheapest form.

In the event that the policyholder dies the insurance payout would be sufficient to clear the. What might begin as 300000 cover might only be 200000 after eight years and 100000 after sixteen. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years.

However there are a number of reasons to be wary of decreasing term policies and consider other life insurance options. Term life insurance or term life assurance provides a cash lump sum for your loved ones if you die within a set period. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

The level of benefit decreases as the term of the policy runs. As the benefit reduces with Decreasing Term Life Insurance the risk to the insurer falls alongside it. In terms of a standard term policy or a level term life insurance the face value of 850000 would remain constant over the policys life.

The most obvious example is if youre repaying a mortgage. Lump sum is payable on the event of death. A decreasing term assurance policy is usually the same as a mortgage term assurance policy.

If you die within the term the policy pays out to your beneficiaries. Decreasing-term vs level-term cover. Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage.

Although payments stay the same over the term of the policy how much you pay each month is typically less than for level term life insurance. Decreasing refers to the pay-out reducing over time. This form of cover is usually used for mortgages or other loans where the amount owed decreases year on year.

You pay the same amount each month or year but your death benefit grows smaller. Term this means the length of time. AXA Decreasing Term Assurance is a Mortgage Reducing Term Insurance without any cash value purposed for mortgage coverage protection in the event of Death Total Permanent Disability TPD and is catered to those who wants their insurance coverage to be a little more flexible as their commitments and liabilities get smaller each year.

Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. Terminal and critical illness riders. Advantage of Decreasing Life Insurance.

Our Decreasing Cover pays out a single amount that reduces over the term of the policy. Decreasing Term Assurance Explained July 6 2017. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit.

How often your benefit decreases and the amount it decreases is set when you buy your policy. Youll take out a decreasing life policy for a fixed period of time called the term. Reasons to Consider or Purchase Decreasing Term Insurance.

If you pass away near the beginning of the insurance term your loved ones will receive more money than if you pass away near the end. Decreasing term insurance policies will pay your mortgage in the event of death or disability similar to mortgage life insurance. If the life assured survives until the end of the term the policy will expire and there will be no monies payable.

Both policies come with term lengths which can go up to 30 years and they both charge constant premiums over time. With our Decreasing Life Insurance a cash sum could be paid out if you die or are diagnosed with a terminal illness with a life expectancy of less than 12 months while youre covered by the policy. There are several types of Term Assurance.

Find out how level decreasing and increasing term insurance works and how to get the right cover for you and your family. If you dont die during the term the policy doesnt pay out and the premiums youve paid are not returned to you. Level-term insurance pays out a pre-agreed fixed sum to a nominated benefactor in the event of the.

Decreasing-term life insurance is a cheaper form of policy that pays out less as time goes on. The premiums do not however reduce. One of the biggest advantages of Decreasing Mortgage Term Assurance is that the policy can be aligned with your mortgage falling as the value of your outstanding mortgage debt falls over time.

The sum assured under the policy is only paid out if death occurs within a specified term. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. Decreasing Term Insurance Explained.

This lump sum decreases by a fixed amount during the period of the term decreasing to nil by the end of the insured period. The cash sum could be used by your loved ones to help pay off an outstanding mortgage. Remember if you have an interest only mortgage you will require a different type of life.

You pay for the cost of the insurance either annually or. While decreasing-term is ideal for those looking to ensure that they are covered for the total remaining sum of their mortgage repayment in event of death it isnt the ideal solution for everyone. Decreasing this means that the value of the final pay-out lowers over time.

Decreasing term life insurance is aimed at people whose financial commitments reduce over time. With term insurance if you die while the policy is active your family receives a cash payout from your insurance company to use however they like. In this article youll learn what decreasing term insurance is why it might not be the best choice and alternative.

Most decreasing term life insurance policies come with or allow you to addon terminal and critical illness ridersA terminal illness rider is usually included at no additional cost and allows you to access your policys death benefit while still alive if you need the funds to cover expenses such as hospice care the hiring of a caretaker or residence at a. There are three main types of term assurance to consider level-term decreasing-term and increasing-term insurance.

Term Life Insurance Guide Vitality

Indexed Universal Life Iul Insurance Understanding Crediting Universal Life Insurance Life Understanding

Read Our Faqs And Info On Life Insurance Moneysupermarket

Mortgage Protection Insurance Vitality

Better To Invest In Term Plans Than Return Of Premium Ones Businesstoday

Decreasing Life Insurance Life Cover Legal General

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Life Insurance Cover Quotes Uk Budget Insurance

Term Life Insurance Guide Vitality

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

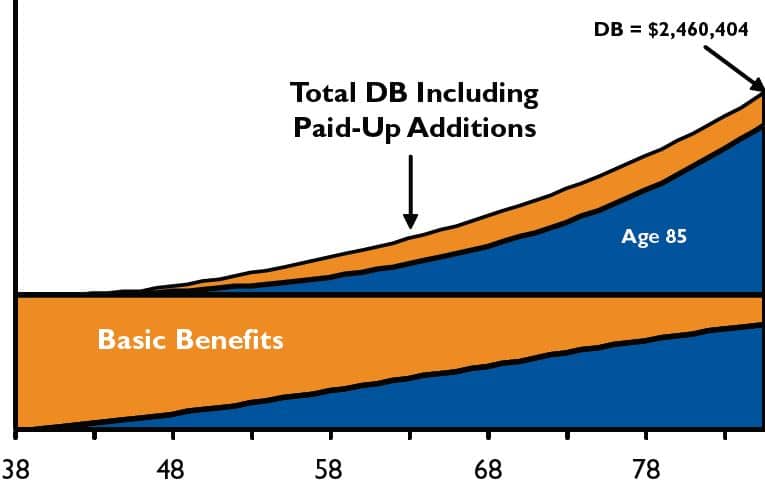

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Decreasing Term Life Insurance Comparethemarket Com

Universal Life Insurance Protection That Stays With You Universal Life Insurance Permanent Life Insurance Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Decreasing Term Life Insurance Comparethemarket Com

Life Insurance Cover Quotes Uk Budget Insurance

Posting Komentar untuk "Decreasing Term Assurance Explained"